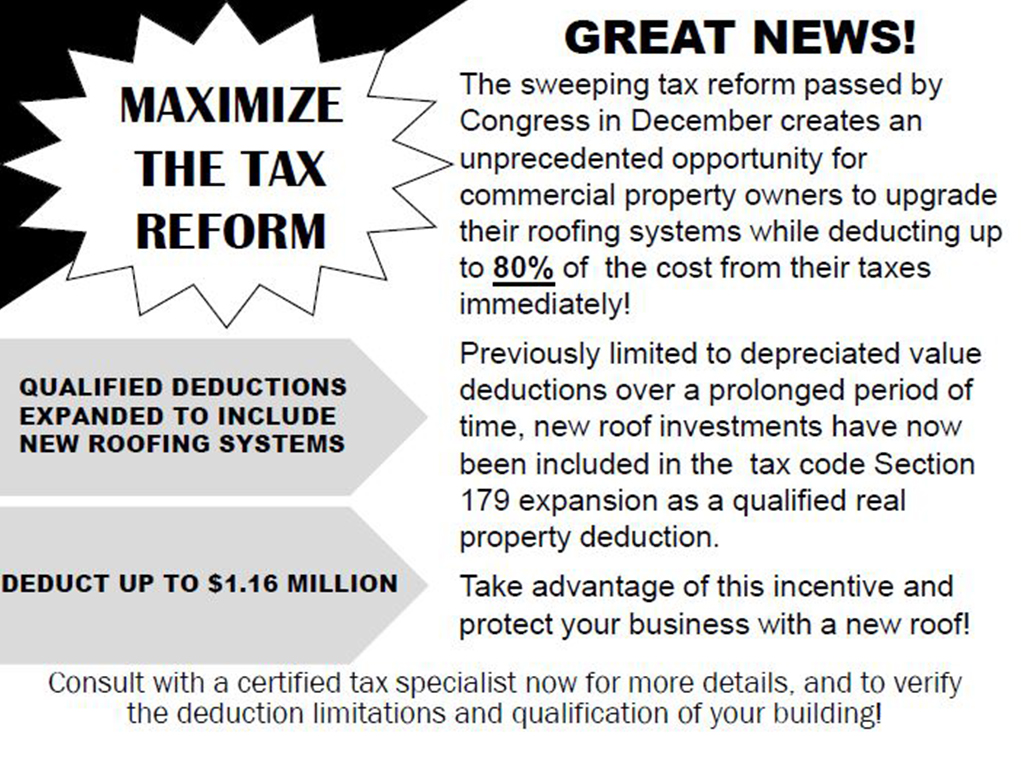

QUALIFIED DEDUCTIONS EXPANDED TO INCLUDE NEW ROOFING SYSTEMS

GREAT NEWS! The sweeping tax reform passed by Congress in December creates an unprecedented opportunity for commercial property owners to upgrade their roofing systems while deducting up to 100% of the cost from their taxes immediately!

DEDUCT UP TO 100% OF THE COST FROM YOUR TAXES IMMEDIATELY

Previously limited to depreciated value deductions over a prolonged period of time, new roof investments have now been included in the tax code Section 179 expansion as a qualified real property deduction.

DEDUCT UP TO $1 MILLION DURING THE 2018 TAX YEAR

Take advantage of this incentive, protect your business with a new roof and deduct the full cost of your investment now!

Consult with a certified tax specialist now for more details, and to verify the deduction limitations and qualification of your building!